01/

Why AutoSingle?

Problems

High volatility

Yield farming rewards from DeFi protocols typically cannot cover losses from price movement during a bear market

Unpredictability of market trends

When users fail to predict different market conditions and suffer from unexpected losses, they refuse to take another step on their DeFi journey

AutoVaults

01/

Fully back-tested

algorithms

02/

24/7

monitor and execution

03/

Minimize

impermanent loss

04/

Seek

the highest risk-adjusted return

05/

More

algorithms are coming!

02/

AutoVault

Automated Delta Rebalancing Vault

Execute rebalancing at optimal moments

CRO-USDC Yield Farming

Assumption:

You used 10,000 USDC in the “CRO-USDC Yield Farming” in VVS since 1 Jan 2022

Implementation:

- Created a position of 10,000 USDC with the composition of 5,000 USDC and 8,944 CRO (~5,000 USDC)

*CRO Price was 0.559 on 1 Jan 2022

Result:

Your position lose 6,590 USDC (-65.9%) in value on 20 Dec 2022

ROI

-65.90%

Max. Drawdown

-68.19%

No. of Rebalance

N/A

3x CRO-USDC Auto Delta Rebalancing Vault

Assumption:

You deposited 10,000 USDC in the “3x CRO-USDC Auto Delta Rebalancing Vault” in AutoSingle since 1 Jan 2022

Implementation:

- Created a position of 30,000 USDC by borrowing 5,000 USDC and 26, 833 (~15,000 USDC) from lending pool to achieve market-neutral setup

- The AutoVault rebalanced 28 times from 1 Jan 2022 to 20 Dec Jan 2022

*CRO Price was 0.559 on 1 Jan 2022

Result:

You will earn 835 USDC (+8.35%) on 20 Dec 2022

ROI

+8.35%

Max. Drawdown

-5.00%

No. of Rebalance

28

Benefits

Minimize

the losses resulting from price effect and impermanent loss.

Detect

the optimal moment of rebalancing

Rebalance

to optimize equity value

Optimize

the swap amount and trading fee

Adjust

the leverage to increase yield return

03/

Single Finance vs

AutoSingle

AutoSingle is a part of the Single Finance universe. When more capital flows into AutoSingle, veSINGLE holders can also be benefited from it

Control your strategy with user-friendly tools

Farm any pair on Single Finance

Earn extra SINGLE reward with veSINGLE

Fully back-tested bots that execute rebalancing for you

Hand-picked pairs for Auto-farming on AutoSingle

Generate AutoCell with AutoS staking to join AutoVaults

04/

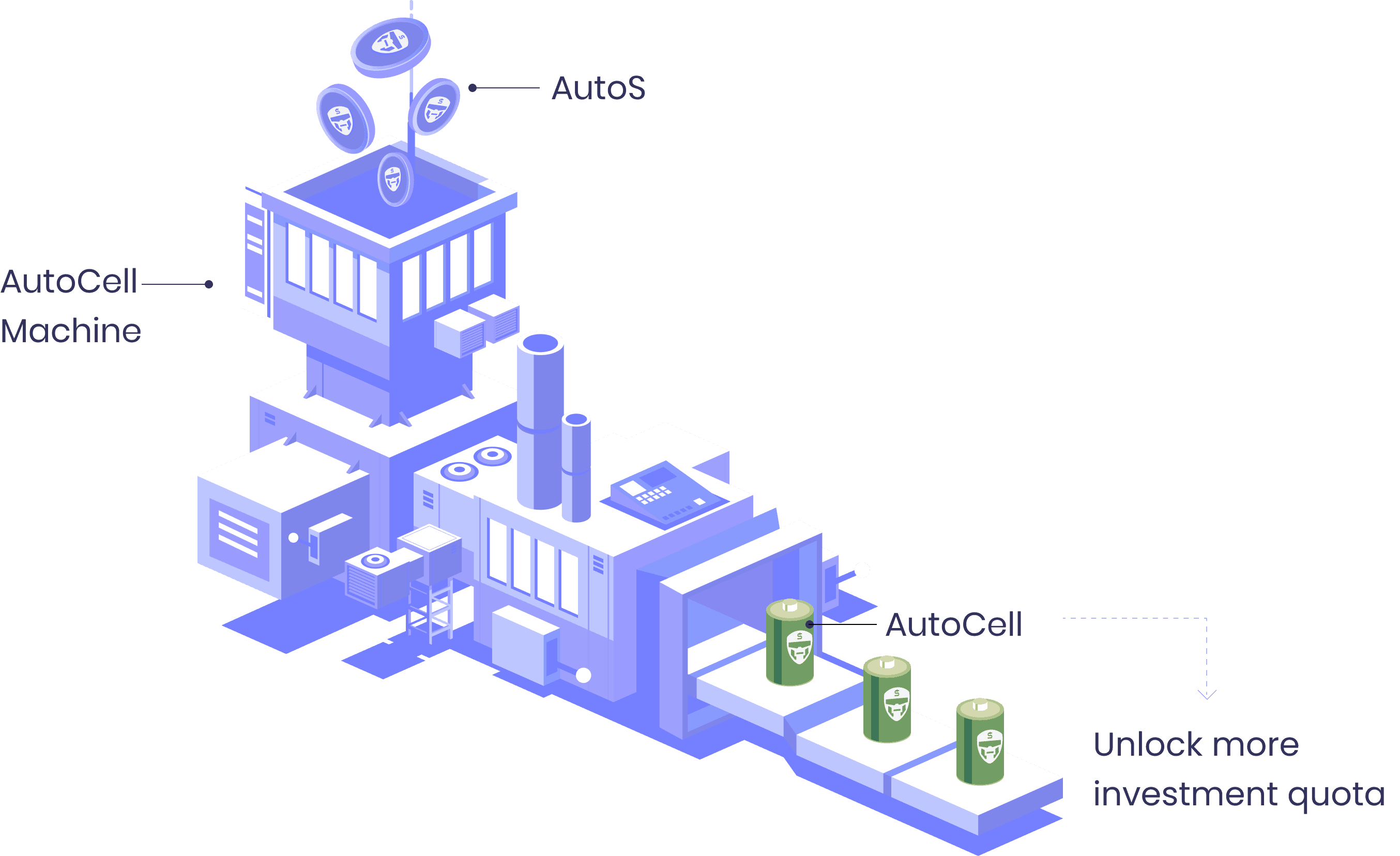

AutoCell Machine

AutoS is the native token of AutoSingle protocol which is used to generate AutoCell. AutoCell is the fuel to unlock AutoVaults. AutoCell is non-tradable and time-sensitive: the earlier AutoS is stacked, the more AutoCell will be generated

05/

Tokenomic

/ Name

AutoSingle

/ Ticker

AutoS

Launchpad - Provides initial funding through launchpad

Ecosystem & Liquidity - Pays expenses including listing fees, audits, extra rewards for ecosystem, etc & reserves for expanding liquidity pairs in different AMMs/DEXs

Development - Supports for continuous development

Partnership - Pays strategic expenses including extra rewards for partnership and marketing fee, etc.

Community -Rewards our community with airdrop, extra rewards, etc

LaunchPad

8%

Ecosystem & Liquidity

35.5%

Development

15.5%

Partnership

16%

Community

25%

06/

Roadmap

2. Launch AutoCell Machine for AutoS token holders to accumulate more AutoS and AutoCell on Cronos

2. Expand coverage to more pairs

2. Expand coverage to more chains, more DEXs with more pairs

FAQs

While skilled farmers can predict and handle different market conditions by using various DeFi strategies, retail investors typically have a difficult time understanding the complicated mechanism behind those strategies and deciding when to use them. We wanted to create a platform that can automatically adopt to different market conditions, no matter the size of your investment amount and whether or not you are a skillful investor. AutoSingle provides users with the best AutoVaults to maximize return while minimizing risk.

The Auto Strategy Vaults of AutoSingle are built on top of the leveraged farms and strategies of Single Finance. All parameters of the Auto Strategy Vaults were determined after intensive back-tests were performed. We will start with automating our pseudo market-neutral strategies, where the algorithm will determine the optimal timing of rebalancing the positions to delta-zero. Thereafter, we will expand to bring you more strategies.

Single Finance provides single-click solutions on leverage yield farming and pseudo market-neutral strategies, users can adjust their positions according to market conditions manually. AutoSingle provides automated yield farming strategies with fully back-tested algorithmic bots, users can earn reasonable return with less manual effort.

By introducing more exclusive DeFi yield farming automated strategies, the TVL of AutoSingle Protocol will keep increasing. A part of the performance fee collected on AutoSingle will be allocated to burning SINIGLE token.

As lending pools on Single Finance Protocol will be strengthened as well, the Single Finance community will be able to run strategies at a cheaper cost.